Fintech App Design & Development - Charge Finance Budgeting App

Plaid-integrated, cross-platform budgeting app built in Flutter.

- Client

- Charge Finance

- Year

- Service

- Fintech App Design & Development

Budgeting App

I've never really liked any of the budget apps I've used over the years. A quick typeform survey proved that just over half of participants survey also felt like they still had to "hack" their budget app in order for it to work best for them. Over 90% of participants in the survey also confirmed that they had at least one credit card in addition to their debit/checking account.

Empathizing with common pain points

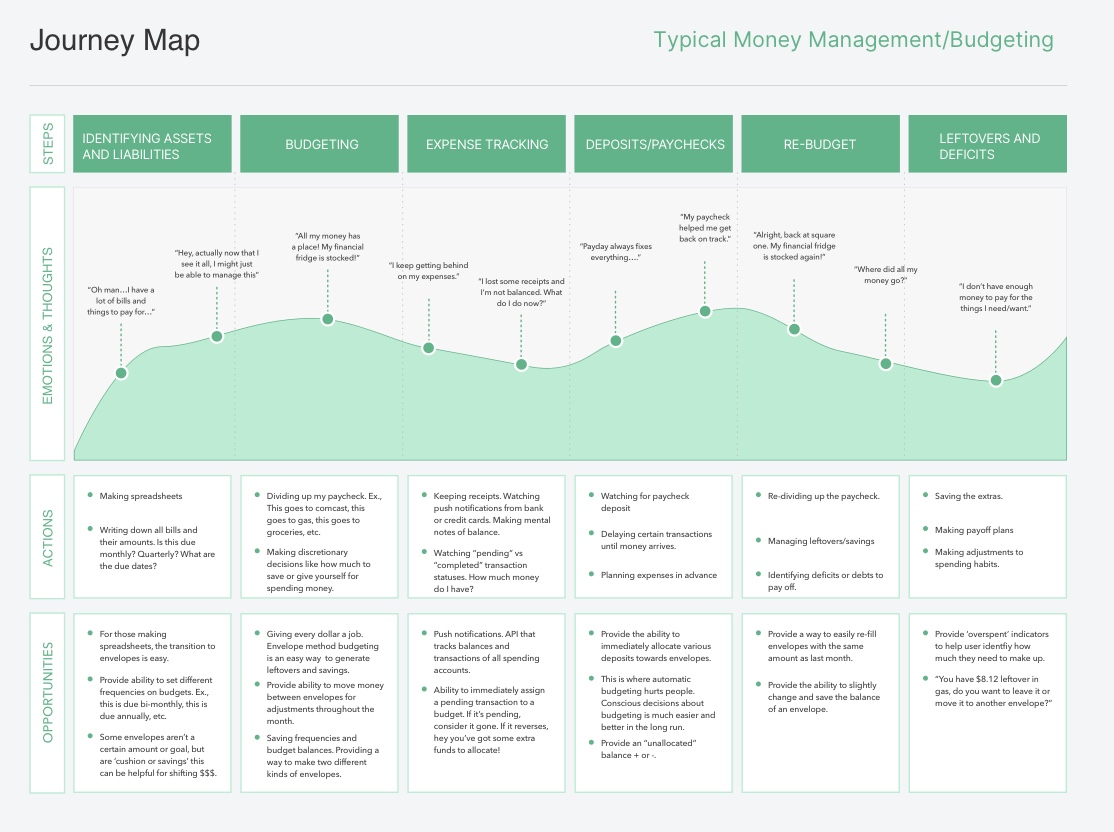

To gather the best insights, it was helpful to perform both qualitative and quantitative research into how people use budgeting apps. A quick survey revealed that the majority (over 80%) of people had at least 3+ spending accounts that they were managing money across on a daily/weekly/monthly basis. In person interviews revealed several popular money management apps like Mint, YNAB, Dave Ramsey. These interviews helped reveal what kinds of things they “wish” they did, what were common complaints or pain points, and also what things people really enjoyed. A common theme arose - “I wish my bank just did this, but I don’t want to switch banks just to get better money management.” Another thing that was really helpful, was to identify the different processes or ‘journeys’ that users would go through in identifying what money they had available, what bills they had to take care of, and how they were going to manage their money on a daily/weekly/monthly basis. These user journeys became especially helpful in identifying opportunities and also became references in the prototype phase to ensure we were still following similar mental models (and of course introducing some improvements to those.)

Journey Map

Defining Requirements and Opportunities

From the insights gathered from my survey and also in person interviews, common themes arose that naturally started to become what would define this app. Here are a few of the big ones:

- Easy budgeting (many users were manually using spreadsheets)

- Transaction tracking (users wanted to know what they were spending and which account it came from.)

- Not tied to a bank (users didn’t want to switch a bank to get these kinds of features, so why not create a platform independent from any bank? *Transaction and balance tracking API.)

- Money movement across budgets. An easy way to make adjustments to budgets halfway through the month. (S@#% happens! Sometimes we have to take money from one part of our budget to the other to pay for that flat tire.)

- Not too many automatic actions. I discovered that many users were actually quite bugged that budgeting tools would automatically move money or assign certain transactions to a specific type for them. Many felt like their “budgeting” or money management really just consisted of just fixing mistakes made by their budget applications.

Ideation

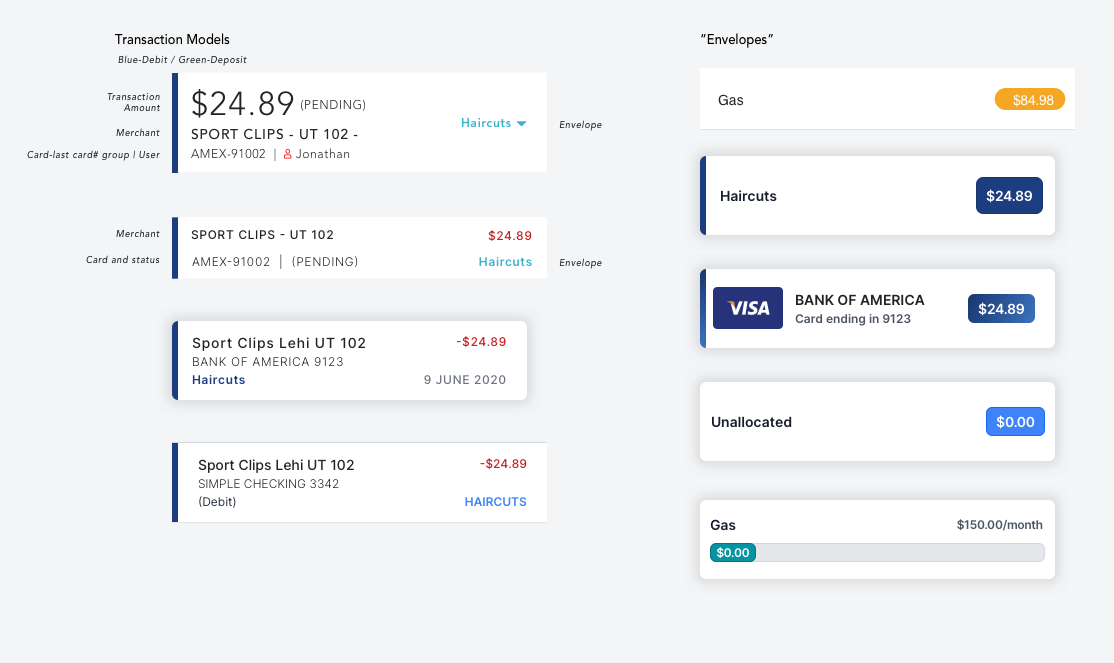

From the empathy and definition exercises, I came to realize that some of the most important things I was going to need to make were a solid transaction model, and envelope method budgeting. This was another area where my user journeys were helpful. It’s easier to think of creative solutions when I know how what users are thinking/feeling/doing during each phase of their money management journey. Here are some different iterations I went through along the way.

Development

This has been fun to learn more about Flutter in general, but to also see what I can actually pull off using AI. That's right, I've been developing this entire app in Flutter using AI. I've been using Cursor and whatever Anthropic's latest and greatest models have been - so far that's been Claude and Opus 4.5. This journey has been a crash course into learning how to use Supabase, cloudflare, Flutter, and many others I would normally just leave into the hands of a capable developement team. This project has really been my sharpen the saw activity for the past few years and I'm excited to eventually launch it some day.

Testing

I'm currently in the beta testing phase of this app and have several users testing the app with multiple kinds of financial accounts. My current challenge is understanding all the edge case scenarios I can, but also the overhead costs per user and how to minimize that as much as possible.

Technologies and Tools

- Flutter

- Cursor AI

- Supabase

- Xcode

- Android Studio

- Claude& Opus 4.5

- Firebase

- Testflight

- Git

- Figma